Research & Analysis

02/13/2024

From 2001-2010 the emerging markets boomed averaging 15% annually while the S&P 500 went through a lost decade. Since 2011 the emerging markets have traded sidways. Is now the time to abandon emerging markets stocks?

02/13/2023

The 60/40 portfolio reset by Vanguard Advisor Services

2022 was painful for investors as they saw double-digit losses (–16.9%) in the 60/40 portfolio (source: New York University and Vanguard, as of December 31, 2022). This led investors to question the validity of the 60/40 portfolio, given they had never seen both equities and fixed income move in the same direction so persistently at such a large magnitude. Investors have been asking Vanguard, "Is the 60/40 portfolio dead?"

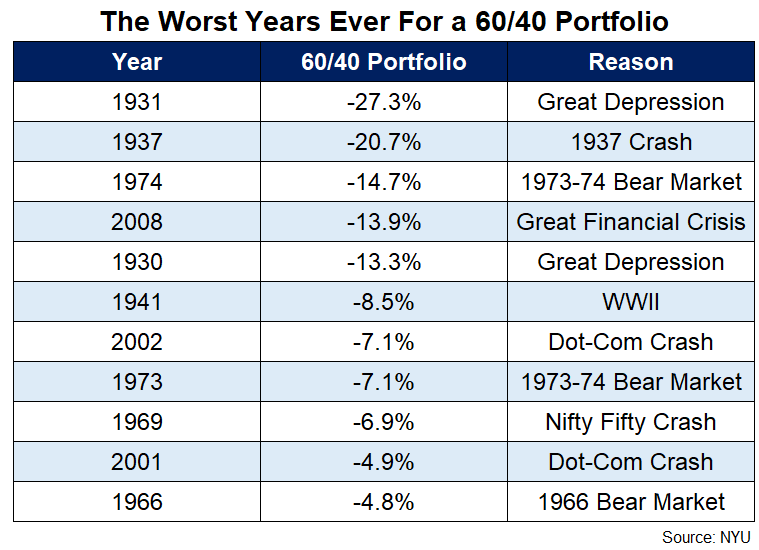

If we consider the worst years for the 60/40 portfolio, they were generally driven by just poor equity performance. Last year, however, was a combination of a very bad year for equities, the seventh worst going back to 1928, and the worst ever year for fixed income (source: NYU and Vanguard, as of December 31, 2022).

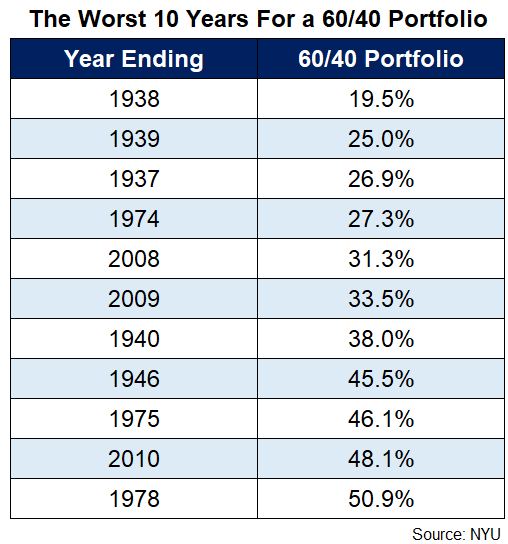

Despite such eye-watering losses in 2022 and investors questioning the logic of the strategy, we urge staying the course in this strategy. The 60/40 portfolio is not immune to losses, and last year's once-in-a-blue-moon event in no way negates decades of evidence that fixed income has been a persistent ballast against equity underperformance. In fact, last year's losses increase the probability that better returns lie ahead for the 60/40.

The history of 60/40 portfolio returns

Nominal calendar year returns of 60% equities and 40% fixed income since 1928

Sources: NYU and Vanguard, as of December 31, 2022. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Note: Equities: S&P 90 Index from January 1926 through March 1957; S&P 500 Index thereafter. Fixed income: U.S. Treasuries.

What was the culprit in last year's poor bond performance? It was a combination of factors: Lack of yield in fixed income to act as cushioning, unexpected inflation, and higher real yields from the Federal Reserve's actions to raise rates.

Let's break down those drivers and why we believe the future looks different:

- Lack of yield. When interest rates rise, bond prices fall. However, with a large enough starting yield, rising rates can have less of an impact on total return when enough yield offsets the price loss. In 2022, the year started with scant yield. On January 1, 2022, the 10-year Treasury was yielding 1.5% as compared with 3.8% at the start of January 2023 (source: YCharts). With higher yields today, investors have a greater cushion in case yields were to rise any more from these levels.

- Unexpected inflation. All asset classes seek to price in perceived risks. One risk that shocked most asset classes last year was inflation rising unexpectedly higher. As a result, investors demanded higher compensation among equities and fixed income, thereby lowering prices of both asset classes. Vanguard believes that inflation has a downward trajectory in 2023 and that the Fed's actions are having an impact on last year's inflation shock.

- Higher real yields. In reaction to high inflation, the Fed reacted by raising interest rates at the fastest clip since the 1980s. Higher interest rates mean investors discounted cash flows at a higher rate, thereby lowering prices. Vanguard believes the Fed has done a lot of the heavy lifting already, and we have completed most of the movement in real rates.

In view of those three elements above, we've seen the brunt of the negative impact these drivers made on fixed income. That means, looking forward, we have much rosier expectations for the asset class.

5/5/2023

We still have this raging debate of recession versus soft landing. So let's take a look at the history of recessions, how they tend to unfold, what the leading indicators are saying and how bear markets tend to mix in.

https://www.schwab.com/learn/story/market-snapshot

04/01/2023

Beyond the 4% Rule: How Much Can You Spend in Retirement?

How much can you spend in retirement without running out of money? The 4% rule is a common rule of thumb, but we think you can do better by finding your personalized spending rate.

Click Below to for the full article:

https://www.schwab.com/learn/story/beyond-4-rule-how-much-can-you-spend-retirement

09/30/2022

After posting gains in the three previous years, the S&P 500 turned sharply negative in 2022, producing its worst annual result since 2008. For the year, the index finished down 18.1% on a total return basis.

The year was an especially difficult one for bond investors, as a U.S. investment-grade fixed-income benchmark, the Bloomberg U.S. Aggregate Bond Index, finished down 13%. As for government bonds, the yield of the 10-year U.S. Treasury bond finished 2022 around 3.88%, up from 1.51% at the end of 2021.

The past year produced a huge performance gap between the value and growth equity styles, with value recapturing the lead following a strong run for growth in recent years. A U.S. large-cap value index fell nearly 8% on a total return basis while its growth-style counterpart dropped 29%.

The price of U.S. crude oil was set to finish 2022 with an overall gain, but a far smaller one that it had achieved in the immediate aftermath of Russia's invasion of Ukraine. On Friday, oil was trading around $80 per barrel, down from a peak 2022 closing price of nearly $124 on March 8. At the end of 2021, oil was trading around $75.

The year saw wide disparities in U.S. equity performance at the sector level. Entering the final week of 2022, energy was the top-performing S&P 500 sector with a 65.7% total return, followed by utilities (1.6%) and consumer staples (–0.6%). Communication services generated the weakest result with a 39.9% decline, followed by consumer discretionary (–37.0%) and information technology (–28.2%).

09/30/2022

After the worst start for the moderate portfolio in over 90 years the article below reminds investors that time in the market is more important than timing the market and that longer holding periods reduce risk.

The Worst Years Ever For a 60/40 Portfolio

07/13/2022

I don't want to be a Debbie Downer here, but I think under the hood, the labor market data is actually a little bit weaker, and the leading indicators suggest a weakening from here. The silver lining, however, is that the sooner a recession happens, the sooner it's over. And from a stock market perspective, we have discounted, I think, already probably a mild recession. We may still have to go through the rerating process in terms of corporate earnings, but a lot of that negative economic news that I think is just coming to fruition, and we're starting to stack up the dominoes that suggests this is more likely a recession, but the sooner we're in it, the sooner we get out of it. And I think that, to some degree, is what the market has reflected. So probably bumper your news from here, but I actually think getting a recession sooner is more of a positive story for the remainder of 2022 than if we push that off until later this year.

https://www.schwab.com/learn/story/market-snapshot

05/04/2022

The potential benefits of tax harvesting may be even better for investors in municipal bonds. By applying tax loss harvesting to a municipal bond portfolio, investors don't simply defer capital gains tax liabilities. The goal is to eliminate capital gains taxes completely.

https://www.pimco.com/en-us/resources/education/easing-the-pain-of-gains/

04/07/2022

All major Morningstar fixed-income fund categories fell in 2022's first quarter as interest rates soared. The Federal Reserve officially raised short-term interest rates by 25 basis points in March for the first time since December 2018, after hinting it would do so for several months. The Bloomberg Aggregate Bond Index, a proxy for the U.S. bond market, fell 6.1%--its worst quarter in almost 40 years--while the average intermediate core bond Morningstar Category fund lost slightly less: 5.9%.

04/04/2022

After the worst bond market rout in decades Vanguard reminds us why it is not time to bail on bonds.

https://advisors.vanguard.com/insights/article/risingratesdontnegatebenefitsofbonds

03/31/2022

As the 2 and 10 Year Treasury spreads close in on inversion Schwab's Chief Investment Stratagist Liz Ann Sonders gives some additional context to this reliable predictor of recessions.

https://www.schwab.com/resource-center/insights/content/recession-blues-unfounded-fear

12/31/2021

After a long period of outperformance in Growth vs Value and Domestic vs International/Emerging Markets Morningstar reminds us why it is important to rebalance to reduce portfolio risk.

https://www.morningstar.com/articles/1070702/you-probably-need-to-rebalance